Suppliers Catalog

This application registers the general information that identifies the Suppliers, performing actions such as registration, modifications, cancellations, deactivations and searches.

New Suppliers Registration

Click on the Add button.

Modify Supplier Information

Through the following actions, the modifications to the information of the registered suppliers are made:

Delete Suppliers

When the supplier has not had any transactions registered, it is allowed to delete or remove it by performing the following steps:

Note

Note

They are only deleted if they have no records.

Deactivate Suppliers

When the supplier has already registered operations, to protect the integrity of the data, it can only be deactivated by performing the following steps:

Search for Suppliers

To access, go to: Administration (Back Office) → Accounts Payable → Suppliers Catalog.

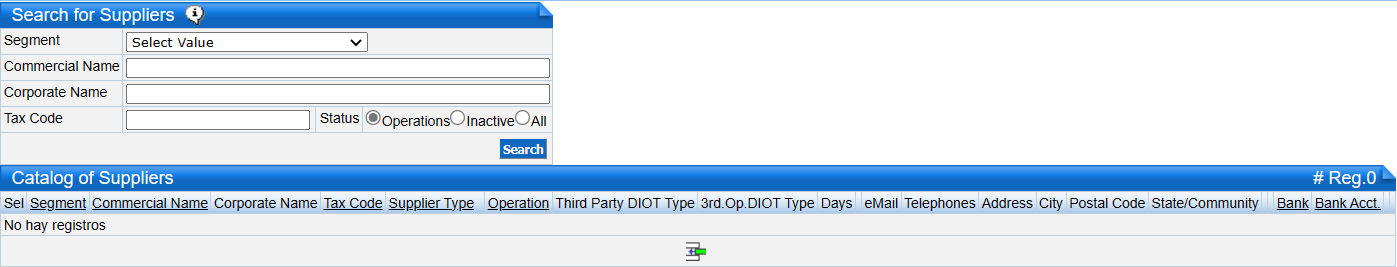

The initial screen shows the following sections:

Search for Suppliers: Allows the search for registered suppliers.

Catalog of Suppliers: Displays the suppliers already registered.

Search for Suppliers: Allows the search for registered suppliers.

Catalog of Suppliers: Displays the suppliers already registered.

New Suppliers Registration

To enter new Suppliers information, perform the following steps:

In the Catalog of Suppliers section, click on the Insert icon.

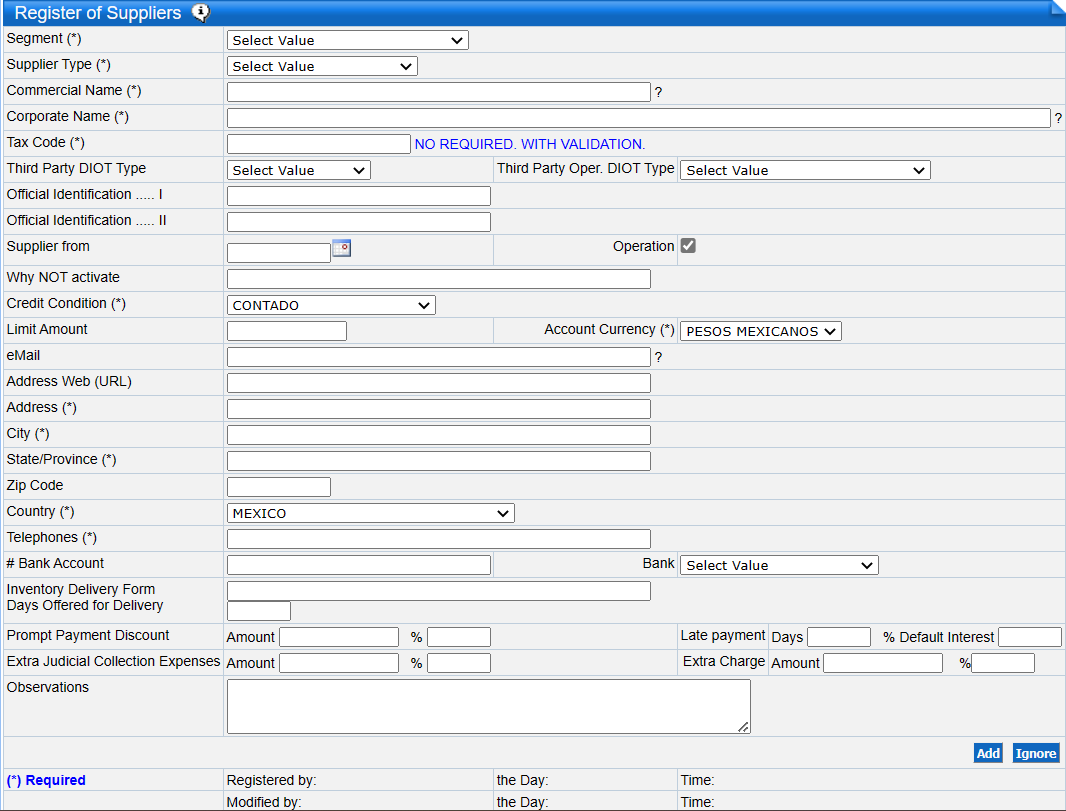

Enter the information corresponding to the Supplier in the Register of Suppliers section in the fields detailed below:

Enter the information corresponding to the Supplier in the Register of Suppliers section in the fields detailed below:

Field | Description |

Segment * | Defines the type of Accounts Payable to which the supplier belongs: national, foreign, services, fees, etc. It must be previously defined in the Accounts Receivable parameters configuration modules. |

Supplier Type * | Indicates the type to which the supplier corresponds, e.g., goods, services, food, etc. to be used for statistical purposes. |

Commercial Name * | The name of the company or name of the establishment that distinguishes it from others. |

Corporate Name * | Legally registered name for tax, legal, commercial, etc. purposes. |

Tax Code * | Tax identification code, the way in which the company is distinguished from other taxpayers for the fulfillment of its tax duties. In Mexico it is RFC (Registro Fiscal del Contribuyente) and in Chile it is RUT (Registro Único Tributario). |

Third Party DIOT Type ^^ | Select supplier type: Domestic, foreign or global, according to Diot (Mexico only) |

Third Party DIOT Type^^ | Select type of operation performed with the supplier: provision of services, leasing of real estate, others, according to Diot (Mexico only). |

Official ID I | Official identification if required. |

Official ID II | Official identification if required. |

Supplier from | Legally registered activity for tax, legal, commercial, etc. purposes. |

Enable * | Click on the check box to make the supplier active (make invoices, transactions, etc.). By removing this option, the supplier will not be displayed to perform any operation with your account. |

Why NOT Activate * | The reasons or causes for the termination of the commercial relationship are entered. |

| Address * | Place of residence or fiscal domicile of the company legally registered for legal, tax, commercial, etc. purposes. |

Credit Condition * | In case the supplier grants commercial credit, specify the term of the credit: days of credit. |

Limit Amount * | Amount of credit granted. |

Account Currency * | Invoicing currency of the supplier, if a supplier invoices in different currencies, suppliers must be opened by currency. |

Email | E-mail address to receive and send e-mails. |

Address Web (URL) | Web site address if available. |

Address * | Place of residence or fiscal domicile of the company legally registered for legal, tax, commercial, etc. purposes. |

City * | Urban area where you have your residence. |

State / Province * | State, province or county in which the company is established. |

Zip Code | Postal code or mailing address of the legally registered address. |

Country * | Numbers with which contact is made via telephone on fixed or cellular devices. |

Telephones | Numbers with which contact is made via telephone on fixed or cellular devices. |

IVA Region | Specify when the supplier belongs to a different region than the company. |

# Bank Account | Bank account number where deposits will be made to the supplier. Account with 20 digits (18 digits in Mexico). |

Inventory Delivery Form | Indicate the form offered by the Supplier to deliver the goods. |

Days Offered for the Delivery | Maximum term offered by the Supplier for the delivery of the goods. |

Prompt Payment Discount | In the event that the supplier grants a commercial discount for prompt payment, the following will be entered.

|

% Late Payment | Conditions to be considered as late payment of the debt, will be entered:

|

Extra Judicial Collection Expenses | Amount fixed between the company and the supplier in case of overdue accounts receivable.

|

Extra Charge | Amount fixed by an authority in case of judgment on overdue accounts receivable.

|

| Observations | Comments regarding the supplier are captured. |

In the Specific Supplier Taxes section select the taxes that apply to the supplier by clicking on the check box.

Click on the Save Taxes button.

In the Taxes Not Applicable to Inventory section the taxes indicated here are mandatory when an Inventory entry is registered. They inhibit the taxes indicated to the inventory products. They are selected by clicking on the check box (Applies to additional taxes on inventory in Chile).

Press the Save Exceptions button.

In the Taxes Not Applicable to Inventory section the taxes indicated here are mandatory when an Inventory entry is registered. They inhibit the taxes indicated to the inventory products. They are selected by clicking on the check box (Applies to additional taxes on inventory in Chile).

Press the Save Exceptions button.

Note

* Mandatory fields.

^^ (Mexico only) Information required in the issuance of DIOT.

Modify Supplier Information

Go to Administration (Back Office) → Accounts Payable → Suppliers Catalog.

Click on the Edit icon of the supplier to which you want to make the information changes in the Catalog of Suppliers section.

Enter the new information in the corresponding fields.

Click the Save button.

Enter the new information in the corresponding fields.

Click the Save button.

Delete Suppliers

Go to Administration (Back Office) → Accounts Payable → Suppliers Catalog.

Click on the Edit icon of the supplier to which you wish to make the information changes in the Catalog of Suppliers section.

Click on the Delete button.

Click on the Delete button.

Note

NoteThey are only deleted if they have no records.

Deactivate Suppliers

Click on the Edit icon of the supplier you wish to deactivate in the Catalog of Suppliers section.

A check box will appear in the Enable field, indicating that the supplier is active. Press to deactivate it, once deactivated, no transactions will be allowed for this supplier, but it will remain in the database.

Press the Save button.

A check box will appear in the Enable field, indicating that the supplier is active. Press to deactivate it, once deactivated, no transactions will be allowed for this supplier, but it will remain in the database.

Press the Save button.

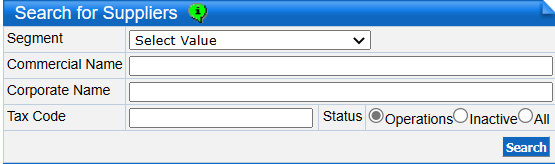

Search for Suppliers

To search for suppliers, perform the following actions:

Go to: Administration (Back Office) → Accounts Payable → Suppliers Catalog.

Go to: Administration (Back Office) → Accounts Payable → Suppliers Catalog.

Enter the information corresponding to the supplier you wish to search for, in the Search for Suppliers section, through the following fields:

Legally registered name for tax, legal, commercial, etc. purposes.

Press the Search button.

The search result is displayed in the Catalog of Suppliers section.

Tip: You can choose one or several filters, depending on the filters used will be the specificity of the search.

Related Articles

Electronic Accounting Suppliers Catalog

For the integration of the Electronic Accounting the change made to this application was the entry of the Banks field. It is necessary to register the bank account and bank information for each supplier. To register the above information, perform the ...Supplier Contacts

This application registers the information of multiple contacts that allow to have a personalized treatment with the suppliers, making the registration, modifications, cancellations and/or deactivations and searches. Go to Administration (Back ...Electronic Accounting - Mexico

In compliance with the amendments to the tax code with the publication of the SECOND Miscellaneous Tax Resolution for 2014 published on July 4, 2014, FIFTH AMENDMENTS TO THE MISCELLANEOUS TAX RESOLUTION FOR 2014 and SEVENTH RESOLUTION OF AMENDMENTS ...Electronic Tax Documents - CL

Table of Contents of the Electronic Accounting Manuals As Novohit is an ERP that integrates all business management operations, the registration of Electronic Tax Documents (DTE) is integrated into the modules that make up the Front Office, POS and ...Import of Electronic Documents from Suppliers

Through this application you can import, delete and view, from the server or from the Novohit Cloud Storage, the XML files of the CFDI/DTE of the invoices received from third parties: Inventory Management: Importation of the invoice header by means ...